Yes, I know that in the post-2012 election era, this blog will naturally pivot to more philosophical writings, but some economic analyses will come up here and there. This is an example of one of these economic analyses.

As many readers of this blog know, rarely would I conduct an analysis on a simple article such as the one listed above. Usually, as seen in this previous analysis, I prefer digging deeper and analyzing primary-source data... usually involving IRS data tables, OMB information, or anything of the like. Since this is a simple analysis of the second-hand information discussed in an article, it is officially a "quick and dirty" look. :-)

The CNN Money article talks about Obama's hard-line plan on raising taxes on the wealthy. At the bottom, it goes on to list the various increases in revenue for each tax-raising move. Keep in mind, these revenue figures summed up over a period of 10 years. They are:

- Letting the Bush-Era Tax Cuts Expire for High-Income Earners: $1 trillion in revenue raised over the next decade

- Limiting Tax Breaks (and, I'll assume deductions): $500 billion in revenue raised over the next decade

- Increase Carried Interest Tax Rates: $13.5 billion in revenue raised over the next decade

- Imposed the Millionaire Minimum Tax (the "Buffett Rule"): $47 billion in revenue raised over the next decade

- Enact Business Tax Proposals: Though not explicitly clear, this would raise $240 billion in revenue raised over the next decade

Now, using simple math, these five main tax increases raise $1.8 trillion in revenues over the next decade. If divided equally over 10 years, that's $180 billion per year. To put this in contrast, the budget deficit for Obama's 2013 budget is between $909 billion and $1.1 trillion, depending on whose estimate you're looking at. For conservative numbers sake, we will use the $909 billion value, and we can see that by enacting ALL the tax hikes Obama wants, he would be shrinking the 2013 budget deficit by a very small amount. In 2013, should all these tax increases work like Obama has said they would, our government would still have a $729 billion deficit. Basically, as stated numerous times throughout this blog, increasing taxes on the wealthy does very little to close the deficit. While it does have a small benefit with respect to direct revenue increases, the negative effects of increased expenses on job creators and small business owners will hurt employees' pockets, ultimately slowing down the economy further.

There is another part of this proposal Obama has promised: spending cuts. So far, I've only looked at the revenue side of this plan. It's time to look at the spending cut side. Looking at the article, Obama claims he will cut $4 trillion from the federal budget over 10 years. This is obviously an average savings of $400 billion per year.

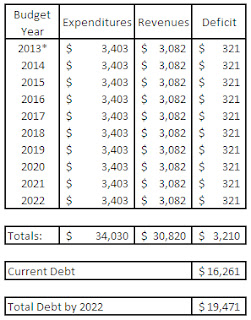

Let's now take a look as to how this all plays out. The following figures are simple linearly-extrapolated numbers based on the conditions we know currently exist in the 2013 budget:

For 2013 - Government expenditures: $3.808 trillion / Government revenues: $2.902 trillion.

According to Obama's $400 billion per year spending cut savings, let's assume the government will then spend about $3.4 trillion per year over the next 10 years (granted this is difficult to predict since entitlements such as Social Security and Medicare are expected to rise in cost due to the aging population). Let's also assume that the government, based on the $180 billion per year increase in tax revenue, will take in $3.083 trillion per year over the next 10 years. The budget situation would look something like this (all dollar figures are in trillions of dollars):

Click image for expanded view

Again, it must be stated that assuming expenditures and revenues stay the the same year after year is a tough sell, but, being that all this discussion centers on estimated spending cut savings and estimated revenue increases, it's semi-safe to say that this chart displays a good approximation of average values. Notice that even with $400 billion per year in spending cut savings factored in with $180 billion per year in additional revenues, significant deficits remain, and more importantly, the total national debt still balloons to over $19 trillion in 10 years. Unfortunately, as the population ages, expenditures are going to rise, and as the economy declines further because of exogenous forces like slow economic growth worldwide and endogenous forces like business-stifling tax increases, revenues are going to shrink. This chart shows very optimistic scenarios, and realistically, it's doubtful that if passed as Obama wants it, this spending cut and tax increase plan will produce smaller in size than the ones shown here.

In short, though this is a "quick and dirty" look at Obama's budget plan proposal, it leads me back to the original conclusion: increasing taxes will do little to help our budget, and spending decreases via entitlement reform are really the budgetary remedy this country needs. If nothing is done soon, as time goes on, our entitlement spending will swallow us further into the black hole of debt oblivion.

Please share your thoughts below.

Hi LME

ReplyDeleteI'm not a 'numbers' gal (as you know) but I DO run a home and I understand one thing: You simply can NOT spend more money than you bring in - and stay afloat.

Out here in the 'real world': If you spend more than you earn and wind up NOT paying your bills, 'they' take your stuff.

Add that We The People borrow money from people who don't particularly 'like' us, who have expressed 'concern' over whether we're 'good' for the debt we owe them - (China and Russia)

Oops!

Obama's 'plan' is to tax the rich... a poem - from the 30's, though cute, pretty much 'explains' the progressive view of this - and how it WILL work out.

Father must I go to work?

No my lucky son.

We’re living now on Easy Street

On dough from Washington

We’ve left it up to Uncle Sam

So don’t get exercised

Nobody has to give a da*n—

We’ve all been subsidized.

But if Sam treats us all so well

And feeds us milk and honey

Please Daddy tell me what the h*ll

He’s going to use for money.

Don’t worry bub, there’s not a hitch

In this here noble plan—

He simply soaks the filthy rich

And helps the common man.

But Father won’t there come a time

When they run out of cash

And we have left them not a dime

When things will go to smash?

My faith in you is shrinking son

You nosy little brat

You do too dam much thinking son

To be a Democrat!

NOT including SS and Medicare, we have who knows how many government 'agencies and programs'. Each and every one of them receives an 'automatic raise' each and every year. This was the MAIN reason our GDP went UP slightly last month.

The 'Penny' plan CUT a measly 1% from EVERY agency/program, EVERY year, compounded and we came into balance in (I think) seven years.

No one even mentions it anymore.

Whether we tax the rich or not - cuts to our out-of-control, wasteful spending MUST be made.

We can do it now, and take the pain gradually - or we can wait until we run out of 'other people's' money and be forced to do it all at once. (See: Europe)

A well thought quick analysis. Thank you

ReplyDeleteHi LME,

ReplyDeleteI think that your post agrees with the estimates I have seen elsewhere (about $.8-$1 trillion of revenue increase in the next 10 years by letting the top bracket tax cuts expire). it serves to demonstrate that any reasonable tax increases will not even be in the ballpark necessary to combat the situation we have gotten ourselves into (the CBO baseline projection assumes ALL bush tax cuts expiring, along with additional reasonable spending cuts, and the debt/GDP ratio would STILL increase over the years). I do think it's currently up for much debate as to whether or not lowering tax rates will have a measurable effect on economic growth (the summary of this particular study suggests that even large tax reductions have relatively small short-term effects, but significant long term effects: http://www.nber.org/digest/jun97/w5826.html, while we all know about the now-notorious, potentially biased, Hungerford study that says there is essentially no correlation between the two: http://www.fas.org/sgp/crs/misc/RL34622.pdf, in general they all agree its tricky to assess), and I agree that the Medicare and Medicaid entitlements (which really just means "the cost of healthcare") should be our major concerns. however, I do feel that tax increases (even across the board ones), should be on the table, as long there is enough supporting data to suggest that the short term revenue increases will not stunt growth significantly. I feel that sending a message to the our markets and the global markets that we are committed to "austerity" could, counter-intuitively, be an effective way to spur economic growth and to keep interest rates low (austerity would involve a mix of increased revenue and entitlements reform); but that is my own personal speculation and I'm not an economist.

Slowdownnn - Thank you so much for sharing your views. It's great to have another opinion in the discussion.

DeleteAs far as the effects of tax cuts/increases on economic growth, yes, it's tough to make a final conclusive case. Some people say they don't have an effect; some do. I look at it not in an empirical way (well, I do use some numbers, but for example purposes only) but in a strictly theoretical way here: http://loudmouthelephant.blogspot.com/2012/02/someone-please-explain-how-increasing.html

I ask the simple question, basically, "how would raising taxes help?"

Now as far as tax increases being on the table... my take is that it should not be done on the wealthy. I back my view on the fact that they're taxed wayyyyy too much relative to the rest of the population: http://loudmouthelephant.blogspot.com/2012/10/im-barack-obama-and-im-going-to-deceive.html

The second chart shows, using IRS data, that 66% of the population pays a final effective tax rate of 5.94% while the remaining third pays a rate of 18.7%. It also shows that the lower two-thirds of taxpayers pay a total of about 8.47% of all taxes paid while the remaining one third pays 91.5%. I don't find this fair, and I think raising taxes on the wealthy only adds to the unfairness.

Additionally, I look at the IRS data here: http://loudmouthelephant.blogspot.com/2012/03/tax-rich-obama-class-warfarecampaign.html

In the second chart we see there are 3.9 million income earners making > $200,000 per year. Conversely, there are 136 million making less. In my opinion, we need to broaden the base. We need more people to pay taxes. For example, as the chart shows, if we raise taxes on those making > $200,000 per year by 10% (which is quite a bit), raising their final tax rate from 26.8% to 29.5%, we would raise an additional $43 billion. If we simply had the remaining 136 million taxpayers, on average, pay a simple $25 in taxes per month ($300 per year), we would raise almost the same amount ($41 billion per year). It just shows, simply, that there are not enough wealthy people to pay taxes, and if we want to really talk about tax reform, we MUST broaden the base and have more people pay. Of course, the left won't do that; it's politically unpopular, and it's tough to get a vote from someone as you tell them, "yes, I think YOU should pay more in taxes." We cannot simply ride the coattails of the wealthy any more.

Thank you again for your input. I hope I get to hear back from you, Slowdownnn.

*jumps in discussion*

DeleteWe actually agree, LME, on one major point: I think that we should broaden the tax base. I don't think we should focus exclusively on taxing the rich more. A true deficit solution should also have some sacrifices made by lower/middle class citizens; and even regardless, I strongly believe that everyone should have some sort of minimum federal income tax bill (even if small).

However, I disagree that increases taxes on the rich should also be completely off the table. Yes, you are correct in that the upper 1/3rd of the country pays 91.5% of the taxes... You also have to keep in mind, that the upper 1/3rd of the country also owns, literally, 96% of the wealth.

Your statistic becomes far less shocking when you include that aspect of the full story here. I mean, it makes sense, does it not? If you've earned 96% of all of the wealth in America, you damn sure likely are going to be paying _close_ to 96% of all the taxes too, no?

RKen - While I can see your point, one of the fundamental flaws I see is mixing income and wealth. While the concept of "who owns the wealth" is one that is hotly debated, when discussing taxation, we are talking about income only. Saying, "if you own 96% of the wealth, you should pay 96% of the taxes" on a technical position, makes no sense (not a knock against you, but something I had to point out). In accumulating wealth, taxes have already been paid. In some cases, on the same money 2 and three times (think taxes of corporate profits that are invested... taxes paid via cap gains, and then passed down as an inheritance).

DeleteWith respect to income, as shown here: http://loudmouthelephant.blogspot.com/2012/10/im-barack-obama-and-im-going-to-deceive.html

33% of income earners pay 91.5% of a taxes but earn only 77.5% of all income. In my personal opinion, we should not be raising taxes on anyone, and if I was in Congress, I would certainly vote against any and all tax increases. Tax rates, to me, should be flat... not only in their application, but in their rate of increase or decrease. Why should we ever raise taxes? All we ever do is set the precedent to raise more. In theory, if we have a relatively steady population growth rate, which we do, and steady inflation, which we do, we shouldn't have to raise RATES at all. But, unfortunately, the government grows, and the amount of taxpayers has slowly been decreasing (who knows why, but I think it's disincentivism)... and here we are again today. Why should we keep raising taxes, and at what point does it stop?

Since what LME said is technically correct, that the through the wealthy's wealth, they have been taxes sometimes more than once, and since the wealthy have more of a propensity to own these things that can be taxed more than once (poorer Americans typically do not pass down large inheritances, own lots of stock, etc.), it's very plausible to conceive that with respect to wealth and this concept of 2 and 3x taxation, the wealthy have paid > 100% of the taxes paid.

DeleteI do certainly agree that if we have to increase taxes our solution should not be to focus them entirely, and unfairly, on the wealthy. over the years the majority of americans have supported the fundamental premise of Medicare and Social Security, and even though now we might want to re-think the basic structures of those programs going forward, it is reasonable to suggest that if we all want to retain those benefits we *might* end up needing to all chip in a bit more than we currently do, depending on how things shake out. Also, there is no doubt that it is probably too small of a pool of individuals to make a difference by itself, as you show.

DeleteI definitely enjoyed reading the blog post you linked to, but I think (as you suggested might be the case) that there is just no way to draw any conclusion about the Bush tax cuts and the low unemployment rate of the following years, at least not from my layperson's perspective. Part of what I want to read up on later is whether or not there are any studies convincingly linking the two. There were just SO MANY other things going on in our economy during that time; the housing bubble, the low interest rates, the generally high consumer/investor confidence index, all of which can lead to businesses expanding and taking greater risks. also, the unemployment low point coincides with the point at which the market began to react to the bubble and the credit markets began to slow and freeze (late 2007).

a few questions:

-where did the $43 billion number come from? do you happen to know what the average income is for individuals in the >$200k bracket? is that the average >$200k income multiplied by the difference between the higher and lower rates?

-what is the average tax rate for the 136 million individuals making less than $200k, and what does a +$300 increase represent in terms of average tax rate increase for those individuals?

-another question is who is included in that 136 million? if that includes individuals who are currently paying very little or no income taxes, then to reach an average of +$300/yr how biased would that distribution be towards the various brackets in the group? in reference to my second question, it's possible that even if the average rate increase in that 136 million people is reasonable, individual brackets may still bear undue burden, depending on how the numbers work out.

I think your numbers are very illustrative of the dilemma that you cannot just focus on one small group of high earners to get all the revenue increases that this enormous country needs, but I also don't want to take for granted that there might not also be some inherent imblance in there as well. it's hard to say just by looking at an "average of +$300/yr" exactly how it will effect each tax bracket, and what sort of a rate increase it results in, especially since I am a layperson. For example, what if to reach that average (depending on who is included in the group) some of the brackets suffer a 15 or 20% rate increase? I know you are just throwing out an example, and I'm just playing devil's advocate (obviously you don't need to actually do the math in the questions I have above) by pointing out that it could still be a complex situation to raise that additional revenue from the 136 million <$200k earners.

however: I agree that it is useless to keep harping on "tax increases for the rich," because it's not only unfair, but also not super effective, and not by any means the only solution we should be looking at. I think that tax increases COULD help only if it is demonstrated that they will increase revenue MORE than they will reduce growth (in which case they sort of benefit us all in the long run), and I think that any bipartisan bill to both reduce spending and raise revenue (even by modest amounts in both categories) will immediately result in an uptick in confidence indexes and potentially real growth due to that higher confidence.

@LME: I certainly agree that they're different metrics in regards to taxation, but I absolutely believe it's still relevant to the topic. I know that we're taxed based on income, and not wealth, and I don't necessarily believe that should change... but I still believe it's a relevant factor to the conversation.

DeleteWhen discussions were had on who needs assistance and how much, it wasn't just about their income, but also their wealth. Medicaid, SSI, welfare payments, etc, don't just factor in your income in determining whether you need assistance but also your wealth. The whole picture; it's a more accurate way to determine who really needs assistance and who does not.

Likewise, in attempting to determine whether or not the wealthy should get a tax cut, a tax increase, or neither, I believe the current distribution of wealth is absolutely a relevant statistic to keep in mind in the conversation. Should it be the only factor? No. The main factor? No. A factor at all? Yes. In addition to income (and other factors).

@Slowdownnn: One aspect of the Bush tax cuts vs job creation argument often left out, is the fact that more than half of the job creation during that period were government jobs.

Deletehttp://www.bls.gov/data/#employment

http://thinkprogress.org/wp-content/uploads/2012/06/BUSHvOBAMA_jobsREV.png

http://www.motherjones.com/kevin-drum/2012/08/bonus-chart-day-public-vs-private-employment-under-bush-and-obama

Slowdownn - I apologize for getting back to you so late, but I wanted to be sure to answer your questions:

DeleteThe $43 billion? - Here is an analysis I did using IRS data for the amount of revenue raised by implementing the Buffett Rule: http://loudmouthelephant.blogspot.com/2012/03/tax-rich-obama-class-warfarecampaign.html

There are 4 charts. The 4th one shows the effects of increasing those who make > $200,000 per year in income's taxes by various percentage increases. In the top line, the 10% increase, under the 5th data column, "additional revenue," the 10% tax increase raises about $43 billion in revenue each year. As far as average income of those earning > $200k, in the third chart on that page we can see that there are 3,924,490 in the > $200k income per year category making a total of $1,619,441,376,000. This means the straight average income would be $412,650 per year.

Average tax rate of those making < $200k (this will be weighted to be high because of those making > $50k: see this analysis: http://loudmouthelephant.blogspot.com/2012/10/im-barack-obama-and-im-going-to-deceive.html) = $13.3% according to the original chart #3 from the first link

continued:

An additional $300 tax increase on 136 million taxpayers would yield $40,971,891,100 per year. This would push the average tax rate to 14.58%.

DeleteAs far as who is included in the 136 mil, yes, it includes all tax payers (and tax receivers... the second link, the "I'm Barack Obama and I'm going to..." link shows this.

I hope this answers your questions. Please let me know and I'd be happy to answer any more you might have.

I always prefer math and numbers to philosophy and ideals; that makes the two of us, LME.

ReplyDeleteBefore I go into my take, I'd like to bring up that we should keep in mind here that even Mitt Romney's ambitious financial plan that assumed higher revenues, higher job creation, and higher GDP growth than Obama’s didn't promise to be budget neutral until (at the very earliest) the end of a second term. There isn’t a very big difference in either side’s projected deficits/debt over the next 5-10 years, even if they were able to pass everything they desired to (which of course is also unlikely).

That said, I truly don’t believe there has ever been any person of reasonable importance that even so much as implied that taxing the rich would solve the deficit problems by itself. I feel like this is a strawman that tends to get beaten on, rather than address the fact that it’s only meant to be *part* of a potential solution.

This, to me, is no less disingenuous than when the left attempts to mock the right with “Republicans think that cutting PBS/Planned Parenthood/Food Stamps will solve the deficit problem.” Fact is, no serious Republican has said/implied that, and of course it is completely untrue. Cutting all three of those programs would barely even reduce the deficit by 1/10th.

Knowing that ‘taxing the rich’ is only supposed to be *part* of the solution, it actually adds up to a sizeable piece. Does it solve it by itself? Of course not, and again, no one ever said it would. But the fact of the matter is that a serious deficit solution will have to have many, many comprehensive changes to our budget.

It's almost as if people expect there to be one easy, simple solution that can be summed up in half a sentence that will solve all of our problems… but that doesn’t exist. Some changes will have to be small, and some will have to be big, and there will be many of both. And in the end, everyone should have to sacrifice something, ideally (poor, middle class, and rich alike). But whether a change is big or small, complex or simple, or focused on one group over another, is no excuse not to consider it.

I see a lot of double talking on this specific issue too… We have the GOP platform that involves a ‘pass or fail’ budget that exemplifies PBS as an instance of where to cut (one of the smallest aspects of our budget), but then the same people will argue that something like the Buffet Rule makes such a small difference in our budget (yet, 100x bigger than PBS) it isn’t even worth putting on the table in any serious discussion.

That type of attitude leads us getting no where fast.

This isn’t to say we shouldn’t be debating where to cut/tax and why… because those conversations absolutely should be had. But I just can never accept the argument of ‘it doesn’t solve the deficit by itself, so scrap the idea’ or ‘it isn’t a big enough cut, so it’s worthless.’

To clarify, by the way: Most of my post is more generally written, and isn't meant to be imply I'm specifically addressing opinions/comments LME has directly made.

DeleteRKen - good afternoon, and thank you for your input.

DeleteI have shown, with links from numerous articles (I'd have to search back through the blog) how the left and President Obama have said that yes, taxing the wealthy is a way to reduce the deficit.

As far as it being a sizeable piece? I respectfully don't see it. If these tax increases are enacted, as shown above, they wouldn't come close to putting a dent in the yearly deficit, and we'd still pile on debt. The proposed tax increases supposedly increase revenues by $180 B. That's a small amount compared to current deficits and forward projections.

Out of avoidance of typing the same response twice (I am that lazy, and the finger isn't helping), please read my response to Slowdownnn above :).

I do think it's fair and entirely reasonable to ask more people to pay something. Relying on Mr. Richguy to cover us will run out eventually.

As always, a good debate though.

To your second comment... I know :-)

DeleteMore clarity: I'm not debating whether or not the left has said it is a way to reduce the deficit, because they certainly have said as much.

DeleteBut I do think it would be wrong to imply the left believes that it would solve the deficit by itself. Anyone with a calculator and basic middle school math can see it doesn't and can not. :) But I still see people attack the left with that fact rather often, even though no one is making that argument.

We do actually agree on making everyone pay a bit more, together, but I just don't exempt the rich from that opinion.

I think that $180B per year is actually a decent step. The fact is that, again, there are no practical ways to reduce our deficit that don’t involve a large sequence of smaller steps. There is no secret, simple way to slash a few hundred billion at a time. And I of course invite anyone who feels differently to point to several alternative ways to cut an even greater amount of money from the deficit; which I’ve yet to see.

And again, I can't really accept the argument of 'it's too small to matter' as an argument against a part of a plan.

Hope the finger gets better!

What about Newt Gingrich's famous concept from the GOP primary debates... something along the lines of "we shouldn't increase revenue to keep up with government spending, we should cut government spending to meet revenues?"

DeleteTo me, that's the way to do it... to live within our means. In theory, to raise revenues because we now spend too much means that at some point, we could, since there is no restraint on government spending, have to tax people at a rate that is more than 100% of their income. For me, I don't think we should raise tax rates at all. The American people are not unlimited resources of cash. We should, in my opinion, simply stop the over spending. I know I do it when my budget gets thin :)

The finger is doing okay today. I'm surprisingly able to type a LOT lol... though the great civil debate about a topic I love, taxation, is hard to resist. Sadly, I depart to sit in traffic in 5 mins :(

I actually agree with the concept of what Newt said as well. But, the issue is I think we're long past being able to simply cut our way out of our debt/deficit issues.

DeleteThe reality of our current situation is that it seems we're past the point of it being impossible by anyone's standards to get rid of our deficit&debt purely through cuts, in any kind of a timely fashion. Not without catastrophic consequences that will likely damage our already fragile economy, and send us into another recession or a depression.

That being the case, I strongly believe any practical attempt to address our financial issues will include not just cuts, but revenue as well.

Once we're back to a surplus and a reasonable level of debt, going forward I definitely agree that we should determine our spending by our revenue... and not our revenue by our spending.

Until that point though, I don't see a practical way to get there without using both.